U.S. Investor Picture Of The Week

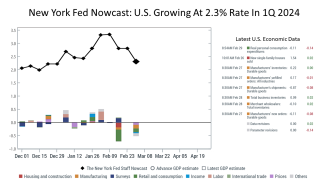

The picture of the week capturing current economic trend this week comes from the New York Federal Reserve Bank’s Nowcast released Friday March 1, 2024.

The colored bars reflect the impact of each broad category of data on the nowcast; the impact of specific data releases is shown in the accompanying table. To be clear, the NY Fed nowcast estimates the current annual rate of growth for the U.S. economy in real time. As new economic data are released, the NY Fed’s nowcast is updated.

The inflation rate declined last month, and new sales of single-family houses ticked slightly higher, resulting in a less robust economic picture for the first quarter of 2024. A week ago, the NY Fed nowcast projected the economy would growth 2.8% in the quarter ending March 31. The data released this past week, shown in the table on the right, resulted in a 2.3% growth rate projection for Q1 2024.

The slowing economy is good news. It makes the Federal Reserve less likely to continue its restrictive policy. The Federal Reserve, which possesses a monopoly on controlling the monetary base, hikes rates 12 times from March 2022 to July 2023, implementing the most aggressive monetary policy campaign in U.S. history.

As the U.S. central bank, the Fed manages the nation’s currency and monetary policy. In contrast to other banks, a central bank possesses a monopoly on increasing the monetary base, giving it influence over lending rates, and, thus, economic growth.

The U.S. central bank is unique. The Federal Reserve manages the world’s largest economy, and a key institution in implementing the 248-year long experiment in American democracy. The NY Fed’s algorithm predicting the current growth rate of the economy is an example of what makes the world’s leading free-market economy unique and strong.

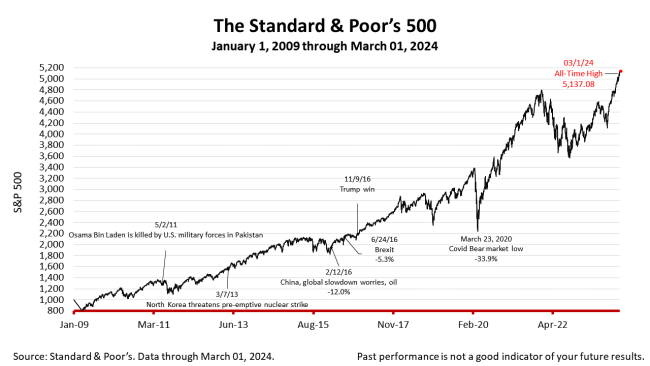

The Standard & Poor’s 500 stock index closed Friday, Feb 23, 2024, at a new record high. A rally in stocks has been underway, driven by better-than-expected sales and earnings reported by Nvidia, which makes semi-conductor chips used in computers running artificial intelligence (AI) applications. Growth of AI could unleash a spike in productivity in the U.S., the world leader in AI.

The Standard & Poor’s 500 stock index rallied Friday. It was “the best February for the S&P 500 and Nasdaq Composite in nearly a decade,” Yahoo Finance said.

The S&P 500, a barometer of the strength of the world’s leading economy, closed Friday at 5137.08, up +0.80% from Thursday and + 0.95% from a week ago. The index is up +129.60% from the March 23, 2020 bear market lows.