Softening Economic Data, Inflation Fears Dampen Stock Rally

Consumer prices rose 3.1% in January, higher than economist forecasts, housing starts slowed sharply, and retail sales slowed, according to government data releases this past week. The disappointing economic news only slightly dampened enthusiasm for stocks.

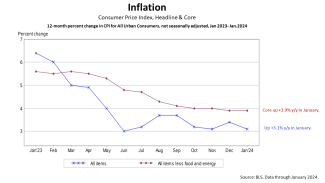

The Consumer Price Index, a composite of a basket of monthly household expenses on food, energy, autos, housing, medical and other costs, rose 3.1% over the 12 months through January. This was higher than the 2.9% rise expected by economists. The Tuesday, February 13, release caused a sharp one-day decline in the stock market.

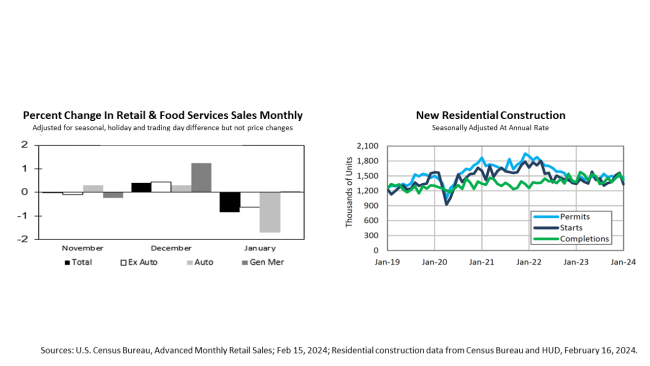

Thursday’s release of the advanced estimates of U.S. retail and food services sales for January 2024, softened by 0.8% from December 2023, and 0.5% lower than the same period a year ago. In addition, housing starts in January came in at a seasonally adjusted annual rate of 1,331,000, which is 14.8% below the January 2023 rate of 1,340,000 and 10.2% below the revised December estimate of 1,562,000. Single‐family housing starts in January were at a rate of 1,004,000, a 4.7% decline from the revised December figure of 1,054,000.

Despite Tuesday’s higher than expected CPI release, the slowing economic data on retail sales and housing is in line with expectations following the 12 interest rate increases by the Federal Reserve between March 2022 and July 2023. So the stock market fell slightly this past week because the data indicated the Fed may need to keep rates higher for longer.

The Standard & Poor’s 500 stock index closed Friday at 5005.57, down -0.48% from Thursday, and -0.42% lower than a week ago. The index is up +123.72% from the March 23, 2020 bear market low. The S&P 500 broke a new record high closing price on Thursday and has repeatedly broken new record highs since early January.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market-value weighted index with each stock's weight proportionate to its market value. Index returns do not include fees or expenses. Investing involves risk, including the loss of principal, and past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.